Why An Umbrella Policy Is Important To The Holidays

With the holidays upon us, many of us are wrapping up our gift lists and finalizing our party plans. But amidst all the festivities, it’s important to remember to protect our assets and loved ones. That’s why an umbrella policy is such an essential investment. In this blog post, we’ll explore why this kind of insurance is particularly important during the holiday season.

The Most Common Insurance Claims in the Fall

Fall marks the start of brisk weather, the onset of various seasonal diseases, and a change in nature’s color. As you take in the sights and sounds of this colorful season, it’s essential to remind ourselves that Fall also triggers an increase in insurance claims. We are referring to insurance claims related to property damages, car accidents, and slips and falls, among others. From homeowners to businesses, everyone is susceptible to experiencing fall-related risks. But how can we prepare for these risks? In this blog post, we will discuss the most common insurance claims in the fall and provide tips on how to prepare for them.

The Unfortunate Connection Between Pumpkin Spice and Home Fires

As we welcome the cooler weather and fall season, it’s tempting to fill our homes with the delightful scent of pumpkin spice and apple pie candles. However, many homeowners may not realize the potential danger of these candles. Fall-scented candles can unintendedly increase your odds of a home fire, especially if you’re not careful. In this blog post, we’ll explore the reasons why pumpkin spice and fall scent candles are potential hazards and what you can do to enjoy the fall season safely.

Preventing Workplace Injuries: 5 Causes of Disabling Workplace Injuries and How to Mitigate Risk

Every employer’s worst nightmare is seeing one of their employees seriously injured on the job. When an employee suffers a severe workplace injury, the consequences can be long-lasting for both the employee and the employer. While some injuries may be minor, many result in severe disability, leaving the employee unable to return to work for a prolonged period, or in the worst-case scenario, permanently. Disabling workplace injuries can be costly for businesses and devastating for employees. In this post, we will cover the top five causes of the most disabling workplace injuries and how employers can mitigate the risk of these injuries occurring.

How Climate Change Can Affect Your Insurance Rates

Climate change is one of the most pressing global challenges we face today, and its effects are becoming increasingly evident. One of the notable consequences of climate change is the rise in extreme weather events, including storms and tornadoes. These severe weather events pose a significant risk to both property and auto insurance, impacting insurance premiums and coverage for policyholders.

Why You May Need More Home and Auto Coverage This Year, Due to Rising Inflation

There’s no doubt that we’re experiencing inflation that’s affecting our wallets and expenses as consumers. From the rising prices of everyday goods to the increased cost of raw materials, it’s no surprise that individuals are feeling the squeeze. However, inflation has an impact on more than just groceries and gas prices. Your home and auto insurance are also affected, which is why you may need more coverage this year. In this post, we’ll dive deep into how inflation affects your home and auto policies and why you may need more coverage in today’s landscape.

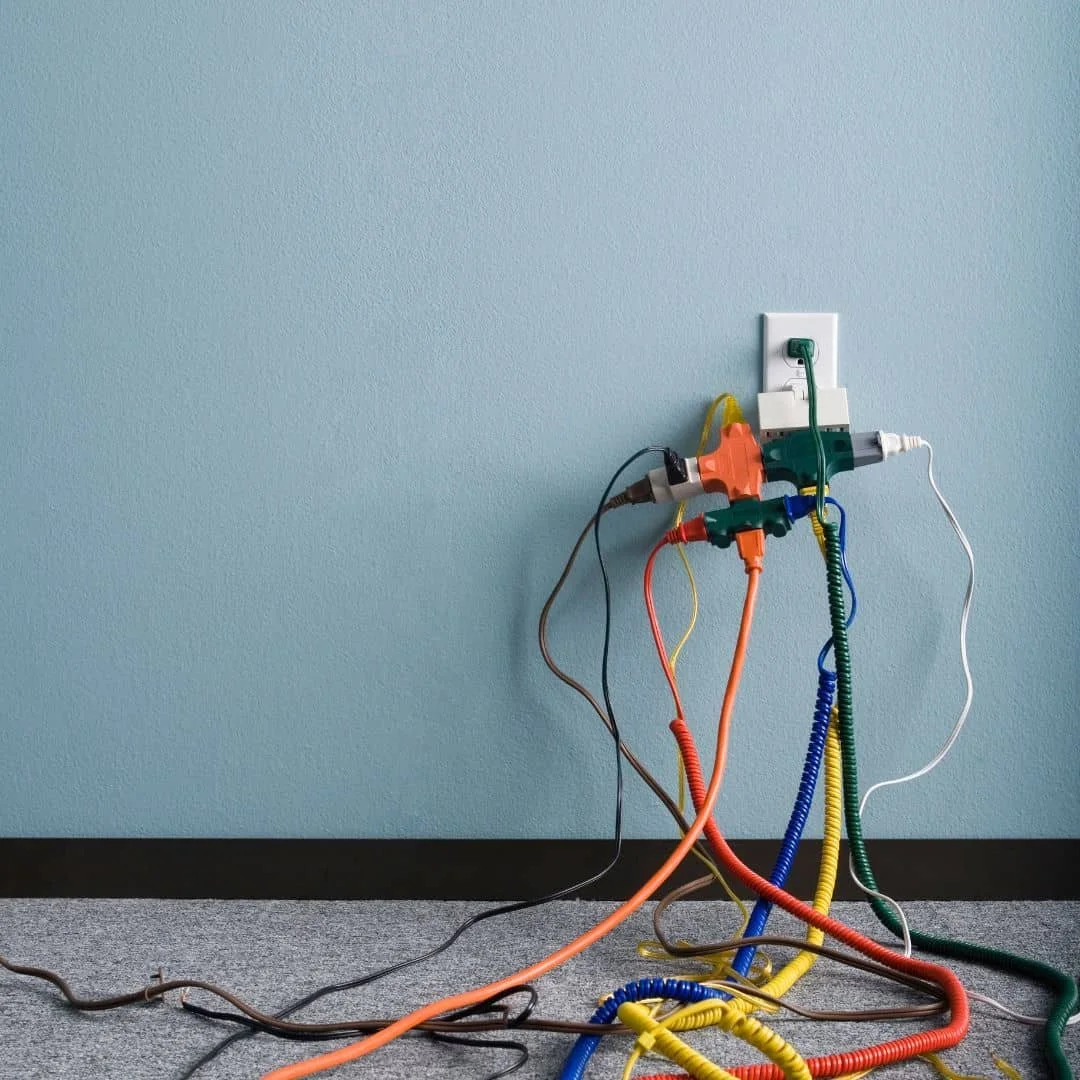

Keeping your Home Safe: How to Control Electrical Hazards

Electrical hazards are common occurrences in households. Data shows that every year, thousands of homeowners are hospitalized due to electrocution or electrical burns. Many of these dangers can be prevented through adequate knowledge and safety precautions. Electrical safety is a responsibility that every homeowner must take to ensure the safety of their family and property. In this blog, we will discuss how you can control electrical hazards in your home.

Mindful Steps - Handling Falls in Your Business

Running a business isn’t a cakewalk, especially if you’re the owner. You’ve got to deal with different situations and problems, including insurance liabilities. In particular, personal injury claims can hurt your business, both financially and socially. As a business owner, it is important to know how to handle falls that may occur within your business premises. In this blog, we’ll give you some tips on what to do if someone falls in your establishment and what insurance you should have to cover you and your business.

Congratulations, you just purchased a new vehicle! Now what?

We know this is an exciting time for you, but before you head out for a spin, we have some important advice: call our insurance agency as soon as possible to get the new vehicle on your policy and here’s why you must make this call sooner rather than later.

What is Umbrella Insurance and Why You Should Consider It

Many people have heard of umbrella insurance policies, but don’t know exactly what it covers and why they should consider getting one. An umbrella insurance policy is a supplemental policy that provides coverage beyond the limits of your existing homeowners, renters or business insurance policies. It is important to understand how umbrella insurance works and why it may be beneficial for you to have one.

How to Handle a Frozen or Burst Pipe in Your Home

As midwestern homeowners, we understand the risks of cold winter weather. One of the most daunting tasks we can face is dealing with a frozen or burst pipe in our home. But fear not! We have all the information you need to help you handle this plumbing emergency and get your home back on track.